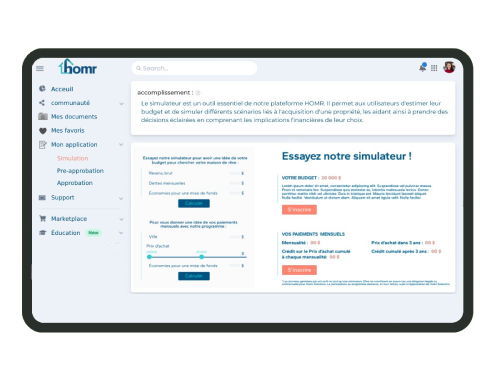

How it works

A new program focused on the needs of aspiring owners to give you tools to increase your chances of becoming a homeowner

Our Rent-to-Own

program in just 4 steps

1 APPROVAL

See if you qualify for the rent-to-own program by answering a few questions. If you are, you will receive a budget for your house search. You can use the real estate broker of your choice or select a real estate broker from our partner real estate brokers.

2 SEARCH & BUY

Once the house is found, Homr secures the purchase of it. You will only have to pay an amount equivalent to as little as 2% of the purchase price, which will be directly applied to your down payment when you buy the house.

3 MOVING-IN

Move into your house and decorate it as you wish as if it were your own. You will have to pay a monthly payment which includes an additional amount applicable to your down payment. If you pay all the monthly payments, you will have accumulated a down payment equivalent to between 5.5% and 10% of the purchase price, depending on your choice, when the time comes to buy your home. All your monthly payments will be reported on your credit report to help you improve your credit score.

4 BECOME OWNER

When the 3 years of our program have passed, you should have accumulated an amount equivalent to the down payment necessary to purchase your house at the price set from day one. If you change your mind and no longer wish to buy the house, you can leave, and we will refund you an amount equivalent to the credit accumulated on your down payment, minus a fee for the resale of the house. It is also possible to buy the house before the end of the 3-year period if you wish to become a homeowner sooner.

Compare for yourself!

You can continue to rent, or you can take the first step towards homeownership by participating in our rent-to-own program.

|

Residential Lease | |

|---|---|---|

| Housing security | ||

| Protection against market fluctuations | ||

| Accumulation of the down payment | ||

| Improvement of your credit | ||

| Choice among houses on the sales market | ||

| Guidance during the purchase of your first home |

This program is designed for you if:

- You need a helping hand raise the necessary down payment to purchase a house

Your credit score is not quite where it should be to be approved for a mortgage loan

You have a new status, a new job, or have been self-employed for less than two years

You are hesitant and would prefer to live in the neighborhood and the chosen house before becoming the owner

Have some questions?

To answer all your questions.

Don't wait any longer to check your eligibility

This process only takes a few minutes, is free, without obligation, and does not affect your credit